What Are Similar Apps to Moneylion?

MoneyLion is a mobile program for banking, personal finance, and lending that makes it easier to borrow, save, invest, and Make Money.

MoneyLion can give you a loan of up to $250 to help you pay for unexpected costs.

It is perfect for people with odd jobs who need to catch up on bills or need one of their upcoming paychecks to make ends meet.

How Do Apps Like Moneylion Provide Immediate Financial Assistance?

Apps like Moneylion are put together in a way that makes sense and is well-organized. MoneyLion is not a bank, and it doesn't work like a bank, either. So, you can get a short-term loan of up to $1,000 with no interest or hidden fees.

But the company will check your bank accounts and credit score. Find out if you were accepted and, if you were, how much money you will get. You will also get paid early, which is always a good thing.

Also, if you sign up for MoneyLion, you can get up to $250 in cash right away to help with your daily costs. The process of signing up takes very little time and effort.

1. Empower

Empower is a great option for MoneyLion if you need a small loan of up to $250 because it doesn't charge any fees or interest. On sales made at stores that accept the Empower card, you can get up to 10% cashback. At any of the more than 37,000 ATMs across the country that are part of the network, the card can be used for free. Empower cardholders can get their paychecks up to two days faster than most other people. If the loan is paid back early, no interest or fees will be charged.

Empower's full set of money management tools costs $8 per month to use, which is the same as competing loan apps like Moneylion. You can try it out for free for 14 days to see what it can do.

The company lets more than 55,000 people take out up to $500 a day from ATMs in its network without any fees. Getting cash from an ATM that is not part of its network costs an extra one per cent.

2. Dave

Human banking, which is another name for it, is a good way to make Money. This could help if the cost of your overdrafts is making it hard for you to pay your bills. Dave will let you know if he thinks you will have to pay extra fees.

When you link your bank account to Dave, you can use your transaction or payment records to automatically pay bills and get paid.

Does Money need help to get? The program gives you a small loan that you can repay at any time, even if it's not mid-month.

Dave, MoneyLion, and a few other apps can help you find work in your area to make more money and take care of other financial responsibilities.

Working a part-time job lets you make money to get by until your full-time job starts.

Dave is much cheaper than other programs because it only costs $1 monthly. But you can give Dave Money to keep the community open if you want to. Dave Banking also offers a savings account that can only be used online.

3. Brigit

Like MoneyLion, Brigit is an app for planning or lending that lets users borrow up to $250.

Brigit needs you to link a bank account that is in good standing and has received at least three direct deposits from your workplace.

You can get a cash advance on your next paycheck, depending on your financial situation.

Brigit is different because it immediately sends you a short-term loan when it notices that your account is about to go overdrawn.

It can help you find a way to make more money, just like it helped Dave Ramsey. You can sign up for Brigit for free, but you won't be able to use all of its benefits.

You can get cash loans whenever needed if you pay $9.99 monthly for Brigit Plus. It is one of the best MoneyLion alternatives if you don't mind the regular fees.

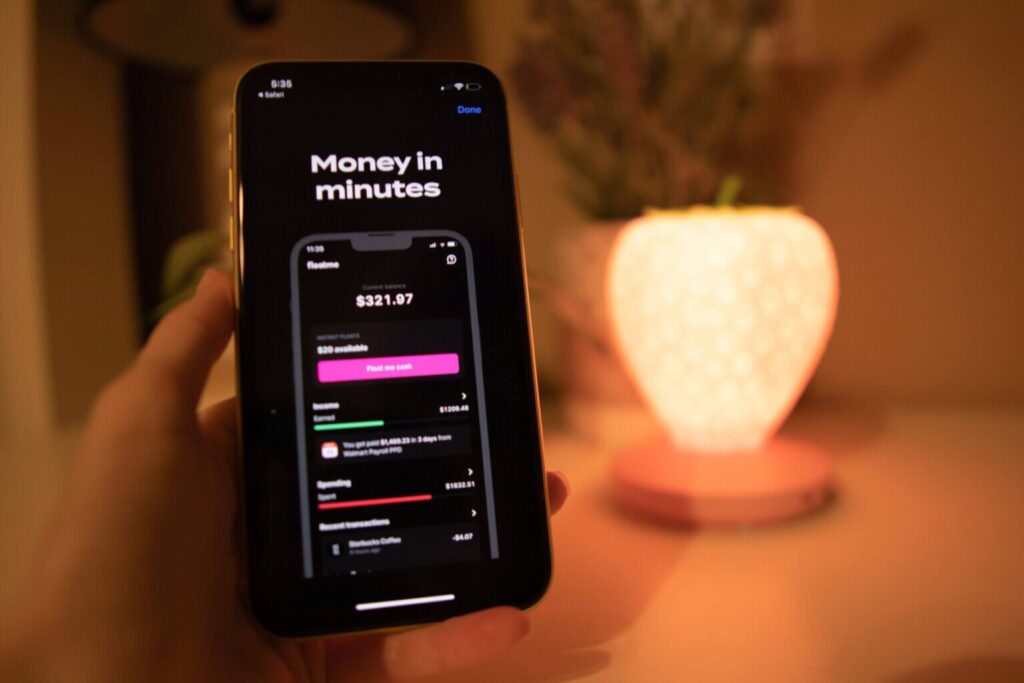

4. Floatme

FloatMe is one of the most affordably priced online pay-per-day services. Due to its overdraft protection and savings features, it's a decent option if you need more cash.

Your financing limit is only $20 when you sign up, so you will need at least two or three advances per year to cover the $24 annual fee.

Users have reported saving thousands of dollars due to the feature's automatic savings function.

FloatMe is incompatible with Chime, Varo, or any other prepaid card.

FloatMe does not currently support Chime, Varo, or prepaid cards. Its budgeting tools and additional services can assist employees in better managing their finances.

Floatme prevents you from incurring an overdraft by expertly administering your funds. You can get paid sooner if you make your payments on time.

5. Cleo

Cleo is a London-based artificial intelligence (AI) Fintech application. Cleo, also known as Meet Cleo, is an app that can be downloaded on Android and iOS-powered smartphones. Over 3.1 million users make it the fastest-growing app in the Financial Technology sector.

The Mobile App Development Services and Facebook Messenger enable users to borrow, make purchases, save, and communicate.

There are over 647 supported institutions, and the setup takes only a few minutes. You can always request assistance if you get stuck during the setup procedure. Creating multiple accounts and navigating the program's more intuitive features is simple.

If you speak or write "budget," for example, the software will assist you in creating a budget. Cleo is a freemium program that functions similarly to MoneyLion and other services of a similar nature.

6. Albert

If you are familiar with MoneyLion, Cleo, or Qapital, you will immediately feel at home with Albert.

In comparison to his competitors, Albert lies in the middle. Mint's free and robust budgeting capabilities may be preferable to Albert's. Cleo, however, cannot compete with Albert due to her lack of investment opportunities.

Qapital charges substantially more than Albert for comparable services. Albert stands out for its extensive collection of practical features compared to its competitors.

This includes the ability to invest, the implementation of automatic Smart Savings, the incorporation of BillShark, the provision of a savings incentive, and the determination of a financial health grade.

By combining financial health scores with the opportunity to ask real financial experts for advice on various topics, Albert is committed to teaching you money management skills and providing a holistic view of your finances.

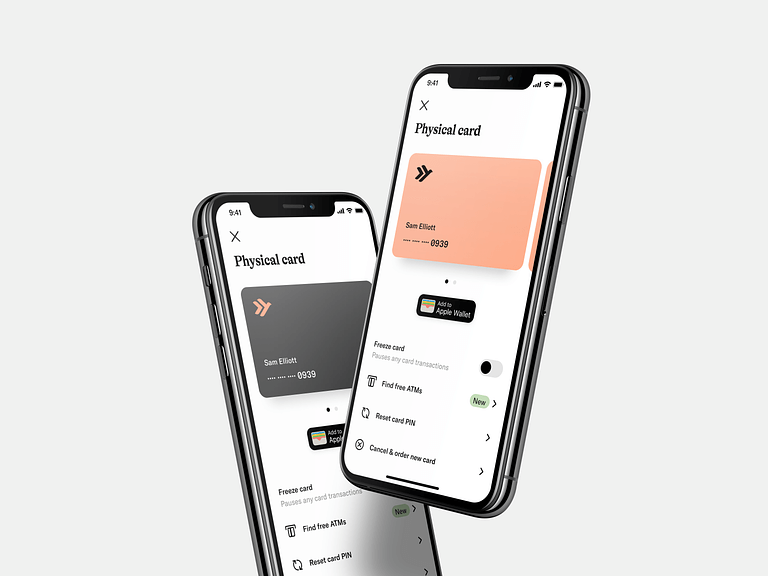

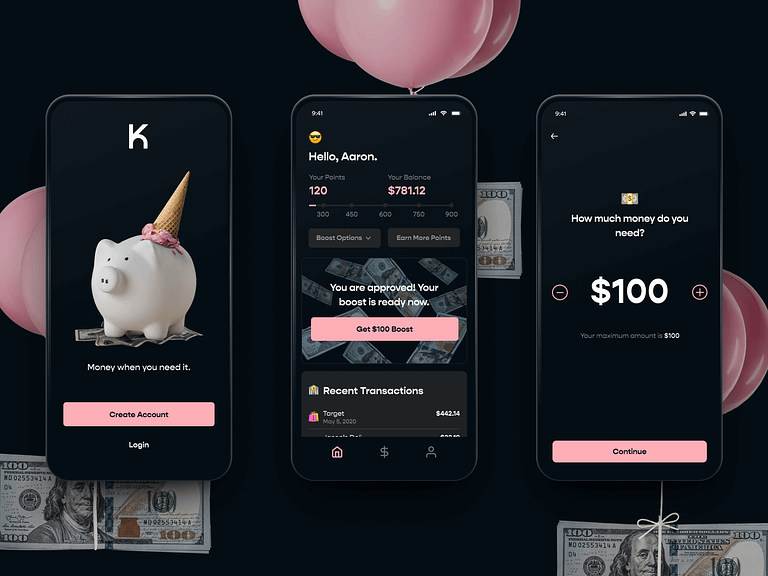

7. Klover:

In addition to MoneyLion, Klover exists. It grants you access to a maximum of $200. Even if your next paycheck is not due until two weeks from now. At Klover, interest and late fees are free.

If you need money before your next paycheck, you can acquire it swiftly using the cash advance tool. The Klover cash advance app awards points for completing surveys and watching advertisements, among other activities.

The Klover app is available for installation from the App Store and Google Play. Advances made through the app incur no fees or interest, but you will be charged for premium features and quicker processing times.

8. Varo Bank

Varo is a mobile banking service that lets people who qualify get cash loans of up to $100. No secret costs or fees come up every month or year. Instead, open a savings account with Varo Bank and earn up to 2.80 percent APY for up to $5,000.

As you might expect from a mobile banking service, there are no physical places to make transactions. Install the Varo app on your iOS or Android device, and then log in to start using the service.

All of Varo's financial needs are taken care of by Bancorp Bank. A big financial firm uses services

like banking and technology from companies like Varo.

In addition to Varo, Chime Bank, and PayPal are on Bancorp Bank's list of business partners.

You will be charged $2.80 when you use an ATM not part of their network. The bank offers several automatic money-saving methods, including "Save Your Change" and "Save Your Pay."

Due to its extensive fee-free ATM network, free debit card, and highly rated Apple and Android phone applications, the Varo Bank Account is the finest checking account option in the current savings market. Varo Bank could be the answer if you're looking for a new financial institution.

9. Instant Cash Advance

When finances are limited, do you seek a financial partner to assist you? You can have faith in the quick loan. By following the app's automated, user-friendly instructions, you can receive a $5,000 loan.

Access funds swiftly and affordably, improve your credit score and avoid overdraft fees with a payday loan. You may qualify for a fast loan of up to $5,000 even if your credit score is low or nonexistent. Installment payments are an excellent method of enhancing your credit score and financial standing.

Stay in the black and receive your hard-earned Money back. Millions of individuals like you are taking charge of their financial futures by avoiding predatory lenders and making wiser financial decisions.

10. Borrow Money: Payday Advance

You can use Borrow Money instead of MoneyLion if you need a loan. A cash advance application is the only way to get a loan with no interest of up to $5,000.

If you're having trouble making ends meet and need extra cash, this app will quickly connect you with lenders in your area, and you can talk to a professional assistant for free to learn the terms. If you want to improve your finances, now is the time to apply online for a private loan and immediately get the cash you need.

When and how can you get a cash loan? A payday loan is a small loan taken out for a short time to help with instant financial needs.

The user can immediately get short-term funds up to the loan's maximum amount. If you need money quickly, this is a great choice to think about.

Users can borrow up to $5,000 with the app's landing generator. You don't have to go to a bank or stand in a long line. All transactions can be done fast online.

Choose money lending software that you can trust to help you meet with lenders. You can use the application to get a cash loan or a loan with payments, whichever is easier.

When Would an App Like Moneylion Be Useful?

Most people are short on cash at the end of the month, which is the best time to use apps like MoneyLion or those listed in this blog.

With these apps, you can get a cash loan within an hour of approval. Getting paid early, before your due date, only requires a few paperwork or formal steps.

Is Prudent When Should a Financial Application Not Be Used?

Well, no unbreakable rule states you must avoid financial applications like Moneylion. If you spend excessive Money or make poor financial decisions, you should avoid this place. This may utterly ruin your finances.

How Well Does Moneylion Perform?

MoneyLion is a free mobile app that offers many useful financial services, such as a bank account, a savings account, an investment account, a way to trade cryptocurrency, and a service to help you build your credit. Standard cash advances to an external bank account take two to five business days. Unlike other applications, there is no monthly fee for cash advances.

There are instant transfers, but they cost $8.99 per $100 moved, almost as much as a payday loan if you need cash immediately. MoneyLion may be less expensive than other cash advance services if you can wait to get an advance until you are sure you need one and if you set up a RoarMoney account to raise your advance amount to $1,000.

MoneyLion's instant transfer prices are higher than other cash advance apps. If you make a lot of instant transfers and don't care about MoneyLion's other features, you'll save money by using one of the other apps.

Conclusion

MoneyLion is one of many advanced applications that simplify everyday financial duties such as budgeting, saving, borrowing, and investing.

With the assistance of such programs, you can eliminate all your financial concerns. Moreover, budgeting has never been easier than with the aid of these programs. You can educate yourself to be a financial expert using these resources.